U.S. lowers de minimis tariffs from 120% to 54% on postal imports from China. Express carrier shipments still face a 30% tariff, down from 145%. Tariffs continue to affect millions relying on budget platforms like Shein and Temu. U.S. consumers, especially in low-income areas, face longer wait times and higher prices. Trade policy shift aims …

Massive Trump-Era Tariff Still Weighs on China’s Cheapest Exports Despite Recent Cuts

-

U.S. lowers de minimis tariffs from 120% to 54% on postal imports from China.

-

Express carrier shipments still face a 30% tariff, down from 145%.

-

Tariffs continue to affect millions relying on budget platforms like Shein and Temu.

-

U.S. consumers, especially in low-income areas, face longer wait times and higher prices.

-

Trade policy shift aims to curb illicit imports but disrupts basic goods supply chain.

U.S. Slashes Tariffs—but Not Enough for Shoppers

Shoppers received modest relief this week as the Trump administration cut the tariff on de minimis packages — low-value imports under $800 — from 120% to 54% for postal services like USPS. Express couriers, including UPS and FedEx, now face a reduced but still burdensome 30% tariff.

An earlier executive order had planned to double the $100 flat-fee for postal packages to $200 by June 1, but that move was also shelved. The adjustments, which took effect Wednesday, offer temporary relief amid the broader U.S.–China trade war.

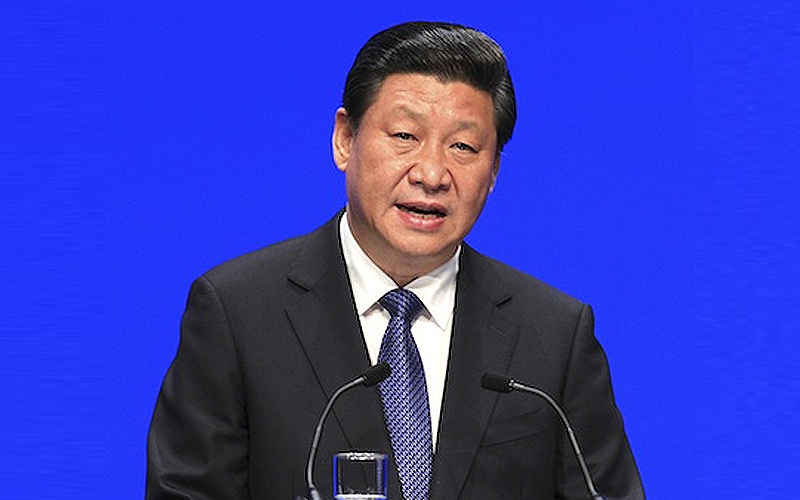

Trade Relations Improve—But Tariffs Linger

Although the relationship between Beijing and Washington shows signs of recovery—with China dropping its tariffs on U.S. goods to 10%—the current 30% baseline tariff in the U.S. is still considerably higher than pre-2021 levels.

“The reality is these tariffs continue to affect working-class Americans who depend on low-cost imports,” said Clark Packard, a policy expert from the Cato Institute.

Consumer Disruption from De Minimis Policy

The rollback affects major platforms like Shein and Temu, which have relied on the de minimis exemption to offer ultra-low-priced products in the U.S. After the original exemption expired in early May, prices surged, and some services like USPS temporarily stopped processing Chinese imports.

In response, Temu overhauled its shipping model and began routing orders through U.S.-based sellers. Shein has also started stockpiling products in U.S. warehouses to maintain availability.

However, the shopping experience has already changed. Multiple customers have reported out-of-stock items and delivery delays, especially in lower-income zip codes, where about 48% of de minimis packages are delivered, according to research from UCLA and Yale economists.

Tariffs Still Target Illicit Imports

Despite the rate cut, the Trump administration defended its position, citing national security. Officials argue the stricter tariffs will help curb the smuggling of substances like fentanyl through de minimis packages.

However, critics say the move punishes legitimate consumers and businesses more than criminals. “It’s going to hurt people that are struggling a little more than average Americans,” said Packard.

E-Commerce Platforms Brace for Holiday Demand

In anticipation of continued volatility, Shein and Temu have ramped up warehouse expansion in the U.S. to reduce dependency on real-time Chinese shipping. The strategy allows them to lock in lower shipping costs while preparing for the upcoming holiday surge.

Still, experts warn that uncertainty in trade policy could disrupt inventories again later this year.

Subscribe to Our Newsletter

Keep in touch with our news & offers